We live in an era where everybody is adamant about their rights, particularly their human rights as citizens. Nobody wants to be a second-class citizen, and it is one of the major areas of progress in the last hundred years that we have a Charter of Rights in Canada – and long before that had eliminated barriers based on sex, race, religion, disability, and sexual orientation. Our Supreme Court has even ruled that non-citizens are covered by the Charter when they are in Canada.

Rights are meant to create equal opportunity, though some on the left believe instead that governments should ensure equal outcomes. That is a separate issue, however, from the fact that rights are not totally free or one sided – they usually come with obligations or responsibilities.

Some like to claim that Canada is a “nation of immigrants”, a concept that is often used by people in the US and some other New World countries. Of course, we have two main types of citizens. There are those who were born here and who get citizenship from birth. There are also those who are “naturalized” – they are first accepted as landed immigrants, and then they apply for citizenship.

There is a third category – people born abroad to Canadian parents, where the child has to apply to get their citizenship recognized. The Liberal government just passed a law to satisfy a Supreme Court decision that determined there were “lost Canadians” born abroad who were being unjustly denied their citizenship based on changes made by Stephen Harper.

Canadian citizenship demands little. People have to obey the laws, and maybe serve on jury duty. During war, people (men traditionally) can be conscripted for military service. Voting is optional – unlike in Australia with their mandatory vote (not voting in Australia can be penalized with a token fine).

Paying taxes is an obligation of anyone deemed residents of Canada, and even tourists of course have to obey laws on taxes. People here on temporary visas also have to pay taxes.

Citizenship itself does not require people to pay taxes if they are not resident. This is unlike the US, where citizens living anywhere in the world are required to file annual income tax returns. Dual American-Canadian citizens living in Canada have to file taxes for both countries, while dual citizens living in the US generally only file US taxes.

I say “generally” because the Canada Revenue Agency (CRA) has rules about cases where someone has broken ties with Canada, and have emigrated.

To not pay taxes, you must fulfill one of several conditions which indicate that you have “severed your residential ties with Canada”. According to the CRA, these include:

- You dispose of or give up your home in Canada and establish a permanent home in another country

- Your spouse or common-law partner or dependants leave Canada

- You dispose of personal property and break social ties in Canada and acquire or establish them in another country

Additionally, if you become a resident of a country which has a tax treaty with Canada, you can be deemed a non-resident and be subject to the same rules as emigrants:

“If you leave Canada and keep residential ties in Canada, you are usually considered a factual resident of Canada and not an emigrant. However, if you are also considered to be a resident of another country with which Canada has a tax treaty, you may be considered a deemed non-resident of Canada. Deemed non-residents are subject to the same rules as emigrants.

If you lived in another country before living in Canada and you leave Canada to resettle in that country, you usually become a non-resident of Canada on the date you leave Canada. This applies even if your spouse or common-law partner temporarily stays in Canada to dispose of your home.”

People can get Canadian citizenship with as little as three years residency in Canada out of five years. This was changed by the Trudeau government, which softened the previous requirement of four years residency out of six years.

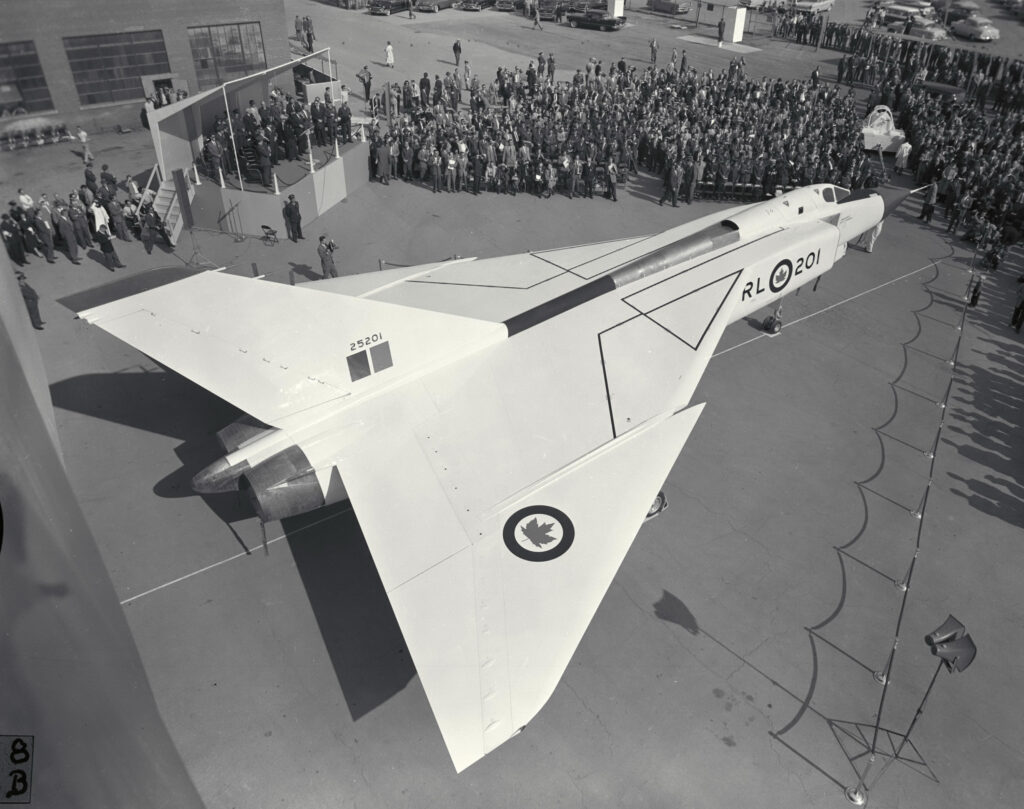

Some people might remember Operation Lion in 2006, when civil war re-erupting in Lebanon led to Canada leasing seven ships to evacuate up to 50,000 Canadians from Lebanon to safety in Cyprus and Turkey – though only 15,000 were helped, many of which were not Canadians.

The following year, the Standing Senate Committee on Foreign Affairs and International Trade released a study on Operation Lion, which included this description of the numbers involved:

“At the time of the crisis, it was estimated that up to 40,000 to 50,000 Canadians were visiting or residing in Lebanon. Approximately 11,000 Canadians had registered with the embassy in Beirut prior to 12 July 2006; by 17 July, this number had increased to 22,000, peaking at 39,100 people at the height of the crisis. The Committee was informed that, by the end of the crisis, approximately 14,370 people had been evacuated by Canada voluntarily.”

It took 34 voyages, costing us $94 million, or $6,200 per person.

Well, guess what? Israel is considering an invasion of Lebanon to deal with attacks from Hezbollah, and Canada is again preparing to help evacuate people.

The National Post ran a story on June 21st titled “Canada reportedly preparing to evacuate 45,000 citizens from Lebanon amid war fears”, stating:

“Canada is preparing a massive evacuation of its citizens from Lebanon should a full-scale war break out between Israel and Hezbollah, Channel 12 reports.

The report quotes from a conversation held Friday between Foreign Minister Israel Katz and his Canadian counterpart Mélanie Joly.

The report says the conversation was tense and that Joly told Katz that the Canadian military was drawing up plans to evacuate 45,000 people from Lebanon.”

There is an old saying, which I first heard uttered by Scottie on Star Trek: “Fool me once, shame on you, fool me twice, shame on me.”

Personally, I would prefer to do away with dual citizenship altogether, but that might be unrealistic. Canadian governments have gone to extremes since 1990, and even more so since 2015, in their belief that high immigration is the key to economic growth and prosperity. Some of the results of this immigration policy have been unexpected. For instance, we ended up with a reported 300,000 people living in Hong Kong with Canadian passports – instead of them working and paying taxes in Canada.

For many people, Canadian passports and citizenship have become insurance for the day when a repressive regime in another country become too repressive. Canada is a safe place to store money – and maybe even kids – until they are forced to flee.

Canada has historically had a problem where the high numbers of immigrants arriving were roughly matched by the number of people emigrating – usually to the US. This has been called “displacement theory”. From Confederation in 1867 to World War 1, Canada’s population mainly grew from a high birth rate as the number of emigrants roughly equalled the number of immigrants. Only after World War 2 did Canada begin to have a large positive net inflow of immigrants – though we also had a high birthrate which also contributed to population growth.

Even if you believe in projects like the Century Initiative, which are based on the idea that Canada needs lots of immigrants to achieve prosperity, what good is high immigration if immigrants only stay long enough to get a passport, then leave? Is the idea that Canada should live on “foreign remittances” like Cuba or the Philippines?

Perhaps it is time for a major reassessment of our policies on citizenship and residency.

Instead of just three years out of five, or even four years out of six, maybe we should follow the example of the US. They require five years of “continuous” residency – breaks of up to six months are not usually a problem, but a break of over one year is hard to overcome.

Canada has a huge problem with citizens of convenience and high emigration rates, so there is justification for establishing a period of more than five years – possibly seven or ten years.

Secondly, Canada should phase in a requirement for all citizens to file federal tax returns, with a period to publicize the change before it is fully in force. Penalties should include fines, jail, denial of government payment or benefits (such as CPP and OAS), and possibly denial of passport renewals. Ultimately, anyone who doesn’t file taxes and is a dual citizen should have their citizenship revoked, with adequate notice. Embassy and consular services should not be provided either, unless a person accepts responsibility to bring their affairs in compliance with the law.

If someone is a Canadian citizen, is not filing their taxes, and needs evacuation from a foreign country, then we should charge them for the cost – and take it out of any federal payments they are eligible for.

Canada’s high level of population growth reached 3.2% in 2023. The national population hit the historic milestone of 40 million in June of 2023, and then hit 41 million just ten months after. As a result of these unprecedented immigration levels, the impacts of high immigration are no longer a taboo in the Canadian media. The Canadian public has long tended towards supporting cutting immigration rather than increasing it.

A lot of the blame has been focused on temporary residents, but the underlying Century Initiative driven policy of 500,000 new permanent residents a year is also unpopular. Even the opposition Conservatives and their leader Pierre Poilievre are talking about cutting immigration, to at least match new housing supply.

But just limiting the numbers of new immigrants will not address the fact that many immigrants do not in fact spend the rest of their lives here – and many leave once their citizenship is confirmed. This leaves Canada without the skills or labour the policy is supposed to provide. We also end up with obligations to new non-resident citizens who paid little in taxes prior to leaving, but demand that Canada continue to provide them with benefits long after. These benefits include ongoing embassy and other services, as well as help if someone ends up wrongly imprisoned, and emergency evacuation in cases of war or civil conflict.

In addition, Canada is being asked to increase our military spending to 2% of GDP to meet our obligation to NATO and allies. Canadians living outside of Canada, in places like Eastern Europe, benefit more from this than do people living in Canada itself, who are far away from Russia, China, and other potential threats.

Lastly, the Supreme Court has decided that non-residents have the right to vote in Canadian elections. Just because someone doesn’t live here doesn’t mean they receive no benefit from Parliament, our courts, and other spending such as foreign aid. The American Revolution had the rallying cry of “no taxation without representation”. I would flip it around and say “no representation without taxation”. People should not be voting for Canadian governments if they only get benefits, and are not obligated to help fund the very government from which they demand services and protection.

All content on this website is copyrighted, and cannot be republished or reproduced without permission.

Share this article!

The truth does not fear investigation.

You can help support Dominion Review!

Dominion Review is entirely funded by readers. I am proud to publish hard-hitting columns and in-depth journalism with no paywall, no government grants, and no deference to political correctness and prevailing orthodoxies. If you appreciate this publication and want to help it grow and provide novel and dissenting perspectives to more Canadians, consider subscribing on Patreon for $5/month.

- Riley Donovan, editor