Newspapers in Canada have been covering the “housing crisis”, with many stories about the high cost of buying or renting a home since the pandemic. Landlords are a frequent target of these stories, particularly over issues like renovictions, high rents, and renting houses to foreign students by placing beds nearly any place one can fit – often with multiple people sharing bedrooms or basements in rooms with no other furniture.

Landlords have long gotten a “bad rap”, and often it is justified. Instead of blaming high population growth for unaffordable housing, people have pointed the finger at a lack of supply and zoning (true in the US, but not in Canada), buyers leaving condos vacant, or short-term landlords renting through things like Air BnB. Small time investors buying condos to rent out have also been vilified – even though there are few new rental buildings being built, so renting out condos has filled the gap to meet demand.

When people want a new car, they have a choice to buy the car and maybe take out a loan, or to lease (in effect, a long-term rental) from the car maker or another company. Most people buy, but leasing makes sense for many others.

Speculators have been blamed for the rise in condo and housing prices, though many people who bought pre-construction condos are now trying to unload them at a loss. This is because of high interest rates, and because rents seem to have peaked in some markets and are now well below the cost needed to cover the monthly expenses of an investor/landlord for mortgages, maintenance fees, and so on.

Speculators are usually defined as people who buy something on the expectation that the price will rise, and they will make a profit on their investment, as opposed to buying something to use for themselves. In fact, most people who buy a home or condo are speculators – they are speculating that the price of the place they buy will increase by inflation over the time they live in it.

Buying a home or condo is also a form of “forced savings” – even if the price doesn’t go up, every month the mortgage payments reduce the principal of the mortgage. After 25 years or so, the mortgage will be paid down, and the home owned free and clear. Even if it costs a little more every month to buy instead of renting, home purchasers expect to be better off in the long run through a combination of paying down the mortgage and any inflation in housing prices.

This is the classic “rent versus buy” decision, but really, this is the wrong way to look at it. I would suggest that if you buy a home to live in, you are in effect renting it to yourself (and your family) and becoming your own landlord. Home buyers are speculators too!

And in fact, while there are people out there talking about “generational unfairness” and blaming Baby Boomers for profiting on real estate at the expense of Gen Z or even Millennials, home ownership might not have been the best investment since 2000.

The TSX Index was 8,481 in January 2000, then dropped to 6,180 in September 2002, and now stands around 23,000 in September. If someone had invested in stocks to match the stock market over 22 to 24 years, this would have coincided with the TSX Index increasing between 2.7 and 3.7 times.

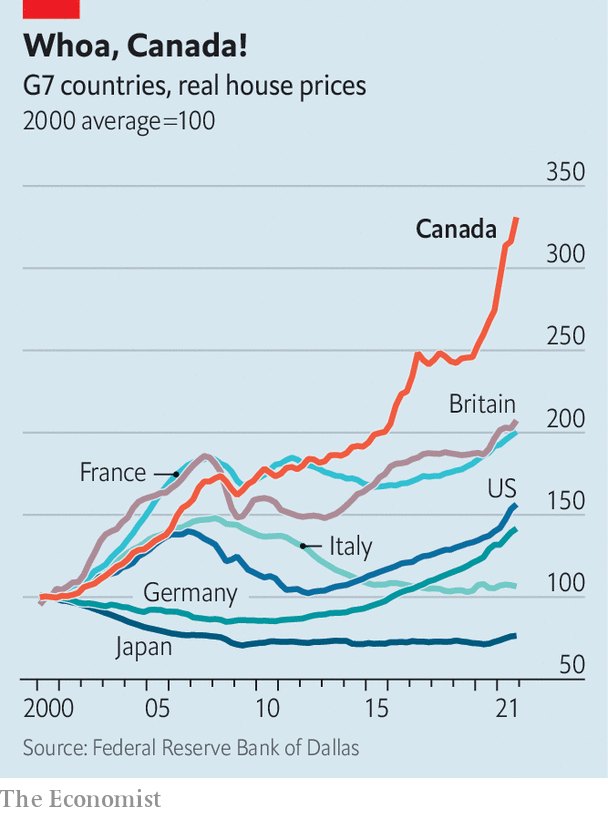

Compare that to investing in real estate. A graph in the Economist showed that home prices in Canada were up around 3.2 times in 2022, with the US and UK seeing a much smaller increase of only around 2.0 times the 2000 price index:

Further, the TSX has actually not performed well compared to US stock markets because it is heavily weighted in things like banks, energy, and commodities.

The S&P 500 was 1,394 in January 2000, then dipped lower in 2002 and 2009. Even so, it is now around 5,500, 3.9 times what it was worth, and 7.5 times what it was worth in 2009.

The tech heavy NASDAQ was 3,490 in January 2000, dipped to 1,172 in 2002, and 1,377 in 2009, and is now around 17,000 (it was a record 18,760 in August 2024). It is 4.8 times what it was in 2000, or 14.5 times what it was in 2002.

Someone who continued to rent instead of buying a home in 2000 to 2002 could be far better off if they had put it all in stocks, particularly if they included American tech stocks or otherwise didn’t just stick to the TSX alone.

Of course, homeowners usually put 25% down, so the returns from “leverage” are higher given the low interest rates on mortgages from 2009 to early 2022. Rates spiked in 2022, but were actually around the rates of 2000 to 2008 (and those were actually low compared to the period between 1979 and the mid 1990s).

The real winners were likely people who invested in Canadian housing in 2009, or in US stocks in 2002 or 2009.

Around the world, it is actually poor countries that tend to have high rates of home ownership, with China topping the list at an estimated 96%, followed closely by Laos and Romania.

Nigeria and the United Arab Emirates (UAE) are the lowest, and both are under 30%. Ironically, it is rich Germany and Switzerland that come next, at 42% and 49% respectively. Canada, Australia, and the US are in the middle of the pack on home ownership rates – all are around 66% ownership levels.

The big advantage of home ownership in Canada is the exemption from the capital gains tax for principal residences. However, homeowners cannot write off mortgage interest (unlike the US), property taxes, repairs, renovations, and other deductions for expenses incurred. A landlord renting to somebody else gets to include all these deductions, and there is also “depreciation” that can be written off by businesses that own buildings they occupy or lease out.

If the federal government eliminated the principal residence capital gains exemption, things would get complicated as homeowners would have to be allowed to claim expenses that they would have to track. If people worked on their own home and that work made the home more valuable, in effect, that would be taxed too!

If anyone is buying a home or any real estate today, the key questions are where interest rates are going, where real estate prices are going in the next decade or more, and also what alternative investments are available? The tech boom of the late 1990s burst, but the growth in tech stocks since 2002 has been massive and consistent (except for 2009) and is unlikely to be repeated.

However, the key determinant of housing prices in any city or country is expected future population growth. Going back to the Economist’s graph from 2022, Italy and Japan had real estate prices that on average were stagnant or fell. This is in large part because their populations have not grown, and actually have shrunk. Some cities might actually be growing (like Tokyo), while in the rural areas real estate values are plummeting like a turkey tossed out of a helicopter in midair.

If someone is buying their first home in Canada today, they need to think like a landlord or speculator in terms of where long-term real estate prices are headed. Prices can drop when supply exceeds demand, which is what is happening in countries that are losing population. Prices can also drop when speculative bubbles pop, because buyer expectation that prices will continue to increase indefinitely are hit in the face by reality, or by mortgage rate increases.

Since 2015, Canada’s population has grown faster than anyone could have reasonably expected, due to high immigration policies that the Liberals implemented piecemeal and not as part of any campaign platform or coordinated strategy. If immigration levels are permanently cut and population growth is greatly reduced, real estate prices in the country should drop – or at least, no longer exceed inflation.

For individual cities, growth might continue anyway – particularly in places like Calgary which are attractive to both businesses and families due to low taxes, moderate home prices, and the unaffordability of bigger cities in Ontario and BC.

Toronto and Vancouver have a different situation. Green Belts, laws limiting urban sprawl, and farmland protection policies are going hand in hand with policies to densify existing urban areas. Land supply is limited or fixed. What this means is that few detached homes are being built. The supply of detached homes is essentially capped, and most growth will be midrise and high-rise condos or rental units. Land is actually only a small percentage of the costs of new high-density buildings, but most of the cost or value of existing detached homes.

As the population of Toronto and Vancouver regions grow, the percentage of detached homes of the total housing stock will shrink. This will mean higher land prices, and a shrinking percentage of people able to afford a detached home, until only a small percentage of the richest people can afford one (like Hong Kong or Singapore).

In the 2021 Census, only 39% of housing units in the Toronto CMA were detached, and only 23.3% in the City of Toronto itself.

Over time these percentages will shrink, and the size of the building will matter even less than today than the size of the lot it sits on. Affordability will get worse for detached homes, but rents and the price of condos will vary depending on costs, interest rates, and incomes. It will also depend on how many people actually leave when rents or prices make it more attractive to leave for cheaper cities, which is what is happening now as population growth from immigration is partly offset by a net loss of people from the GTA to other parts of the province or country.

While only two thirds of Canadians own their homes (including condos), it is considered part of the Canadian Dream to have a home with a back yard, which will become increasingly out of reach in the major urban regions of Canada. But if someone is buying a condo today in Toronto or Vancouver, they need to think like a speculator or landlord and decide if it is the best option and will actually pay off in the long run. This is particularly the case given all of the policies designed to reduce the price of new housing, which is unlikely to make a home with a backyard more affordable in the country’s largest and most expensive cities.

All content on this website is copyrighted, and cannot be republished or reproduced without permission.

Share this article!

The truth does not fear investigation.

You can help support Dominion Review!

Dominion Review is entirely funded by readers. I am proud to publish hard-hitting columns and in-depth journalism with no paywall, no government grants, and no deference to political correctness and prevailing orthodoxies. If you appreciate this publication and want to help it grow and provide novel and dissenting perspectives to more Canadians, consider subscribing on Patreon for $5/month.

- Riley Donovan, editor