Editor’s note: This article was originally published on the Population Institute Canada website (populationinstitutecanada.ca) on August 29th, 2025. It is republished here with permission of the author.

A city in a state of perpetual transformation

I am an eyewitness to the transformation of Canada’s capital from a city of some charm to just another big city that modernity has spawned. These are cities whose endlessly sprouting towers make them barely distinguishable from one another and overshadow their architectural, historical and natural landmarks.

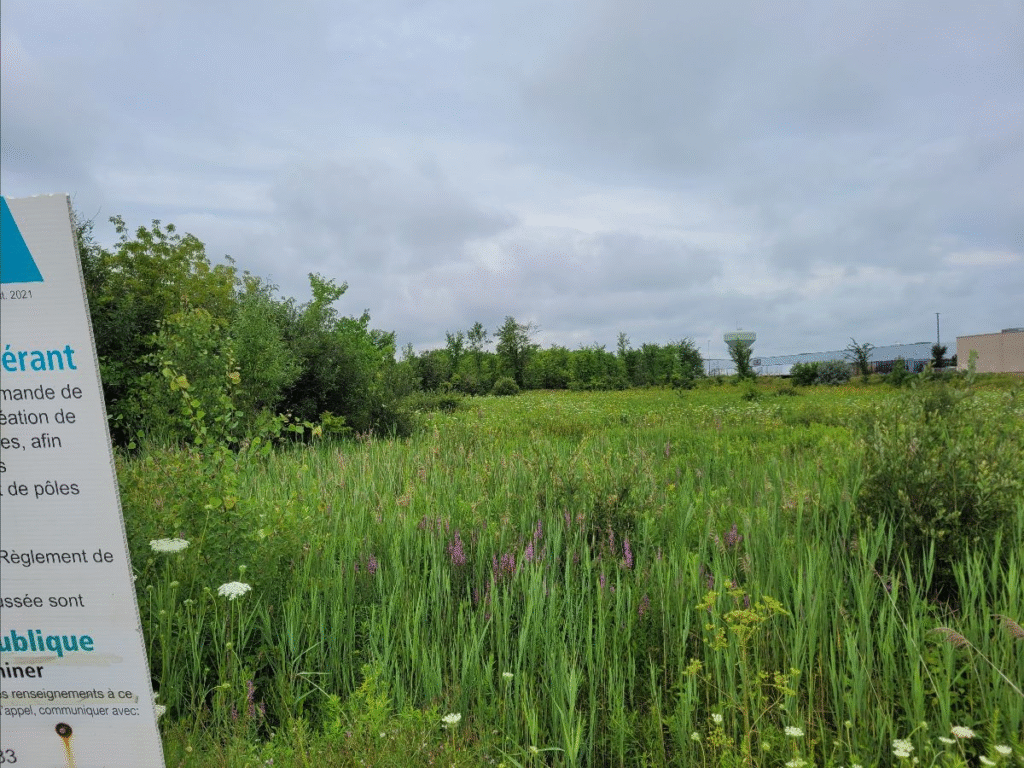

Cities where infills and densification replace patches of greenspace in ever more urban neighbourhoods. Cities where ticky-tacky developments pop up, like mushrooms after the rain, in fields far beyond what used to be the urban boundary. Cities where “rush hour” has become a quaint concept because the traffic never actually stops and perpetual construction can lead to massive slowdowns at any time of day.

Ottawa’s growth has also been accompanied by an explosion in the number of beggars. They ply their trade at many on- and off-ramps of the Queensway near a traffic light, and along many of the city’s boulevards, weaving among the rows of cars made captive by a red light. A visit to the downtown area is unlikely to end without encountering a beggar along a sidewalk or in front of a hotel, bank, or other building.

The transformation is especially noticeable for anyone who has not seen the city for some time. My sister came to visit over the Christmas season for the first time in years and, as we were driving downtown to pick up a friend, commented that Ottawa was becoming uglier. I had to agree with her. On a separate occasion, a visitor who had long lived in Ottawa but no longer does so commented on how the sound barriers now bordering much of the Queensway made the drive into Ottawa a lot less interesting. Of course those sound barriers are well-justified. No one deserves to be exposed to incessant highway noise.

And then there’s crime

When I asked Google (on August 24th), “Has crime increased in Ottawa in the last 30 years,” this is what came up on its AI Overview:

Yes, crime has increased in Ottawa over the last 30 years, with recent data showing rising overall crime rates and a particular spike in homicides, though violent crime overall has seen some recent declines. While there was a significant decline in reported crime in the early 2000s and 2010s, the last decade has seen an overall uptick, especially driven by an increase in non-violent crimes and property crimes like auto theft, according to recent reports.

Key Trends:

- Rising homicides:

Ottawa’s homicide rate has been on the rise in the years leading up to 2024, reaching levels higher than in the previous decade.

- Increase in Non-Violent Crime:

In 2024, the overall crime rate increased by 4%, driven by a rise in non-violent crime categories.

- Property Crime Trends:

Auto thefts, in particular, have significantly increased, with figures showing a substantial rise compared to the early 2020s.

- Long-Term Decline Followed by an Increase:

There was a period of declining crime rates in Ottawa in the early 2000s and into the 2010s. However, recent trends indicate a resurgence.

In summary: While crime levels have fluctuated significantly over the past 30 years, the general trend points to an increase in crime rates in Ottawa, particularly in the last decade and most recently in non-violent offenses.

In response to another question about Ottawa police disbanding its auto theft unit, Google’s AI Overview told me the following:

Yes, the Ottawa Police Service disbanded its dedicated auto theft unit in 2017 due to a rise in violent crime, particularly shootings, which necessitated a shift in officers to address those incidents. At that time, a provincial task force also dissolved, and the city’s police force has since relied on short-term initiatives, though there is a recognized need for a dedicated local team to tackle the persistent issue of vehicle theft.

Since Ottawa disbanded its auto theft unit because of the rise in shootings, it’s no big surprise that auto theft in Ottawa rose dramatically.

Rising crime has caused one of downtown Ottawa’s most iconic areas, the ByWard Market, to lose some of its lustre. Steve’s Music Store vacated 308 Rideau St. in November 2024 after 42 years at the location when pharmacies associated with Ottawa’s safer supply program opened next door and brought the opioid crisis to its doorstep. Previously, the ByWard Market had lost Saslove’s Meat Market, which had been there for 70 years, and other high-profile establishments, including Cantas Fashion, Oz Café, and the Courtyard Restaurant. The situation has improved slightly in the past year because of the increased allocation of police resources in that area.

While rising crime might be the price to pay for reaching big city status, many city residents would no doubt love to make Ottawa boring again.

Municipal taxes rise while services stay the same or decline

The stress of growth is also felt in the services provided by all levels of government. At the municipal level (which may receive provincial or federal support), its impact is noticeable on the infrastructure. Many of Ottawa’s roads show signs of wear and tear. Buildings may not be maintained to the level that they should, as the collapse of a parking garage in downtown Ottawa on February 26 suggests. As the population grows, demand for water and sewer services also rises, requiring the laying of more pipes, while the lifespan of existing pipes is shortened from heavier use. Developers’ fees do not cover the cost of the needed infrastructure for new housing.

Since 1984, I have been living in Ottawa’s exurbia, in a single-family bungalow in what used to be an independent township until it was swallowed up in the grand amalgamation of 2001. While metastasizing clusters of urbanization have come ever closer to where I live, I still get my water from a well and send my sewage to a septic tank. In other words, my dwelling does not benefit from Ottawa’s water and sewage services. And for 33 years, through 2017, I never received a water utility bill from the Township or the City.

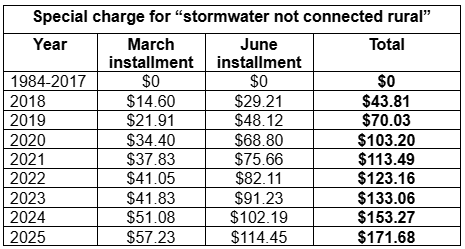

All that changed in 2018 when, for the first time, my City of Ottawa municipal tax bill had a “special charge” for “stormwater not connected rural.” The special charge started modestly enough, with the March and June installments together coming to $43.81. By 2025, my total charges were $171.68. At the risk of subjecting the reader to too much information, my “special charge” for “stormwater not connected rural” over the years is shown in the table below.

The amount of taxes I am paying for a service that I don’t receive has increased by a factor of 3.91 in eight years. The City of Ottawa’s growth is obviously not paying for itself, so taxpayers have to pay for it. Some services are also being restricted even as fees rise. In 2006, a special charge for “Solid waste curbside service” showed up for the first time on my municipal tax bill. That year, I paid a total of $78.90 for the service. In 2025, I paid a total of $364.50.

Yet the amount of garbage one can put out every two weeks has been reduced. That may be a good thing for landfills, but then so would a not continually growing population. And if garbage collectors are picking up less from any given property, why should that property owner pay more taxes for garbage collection? Of course, it’s because the money to pay for the stresses of growth has to come from somewhere.

I suppose I should rejoice that Ottawa’s mayor does not want to raise taxes by more than 3.75% next year.

Applying punitive measures to pay for growth

It’s only to be expected that as costs rise, cities will grab money wherever they can find it. The measures taken by the City of Ottawa are also being taken in many other cities.

Surveillance of traffic with red light and speed cameras has become ubiquitous. The first six red-light cameras in Ottawa were installed in 2000; by August 2024 they numbered 85. Speed cameras were first installed in 2020. The eight cameras installed that year rose to 40 by August 2024. In 2023, the City of Ottawa collected $26.6 million in fines from all of its cameras.

Surprise, surprise, it’s not all about road safety. Nathalie Gougeon, City of Ottawa’s auditor general, found that of the $41 million in total revenue generated by red-light cameras between 2021 and 2024, about 80% was allocated to the City’s general operating budget and 20% was transferred to the Ottawa Police Service.

In 2022, Ottawa implemented the Vacant Unit Tax (VUT). It is applied to residential properties that remained vacant for 184 days or more of the previous calendar year. A Property Occupancy Declaration must be filed March 20th, and a late fee of $250 is applied to declarations filed after that date.

I know someone who bought a building in downtown Ottawa with some associates. The building was not habitable and they were renovating it to turn it into a three-family dwelling. All of them have full-time jobs which meant that renovation work was done after hours. They were fined $7500 in Vacant Unit Taxes plus a $500 late fee for two years despite the fact that they were making the building rentable. They showed the City some before and after pictures, but it made no difference. Perhaps this is just a municipal-level example of how government regulation kills the entrepreneurial spirit.

There have even been suggestions in Canada about taxing empty bedrooms. Why should empty-nesters be allowed to remain in their three- or four-bedroom homes when the kids have left? Australia, Canada’s twin in creating a housing crisis through mass immigration, is seriously considering taxing households with spare bedrooms. It apparently makes sense to different levels of government that homeowners should be punished for federal immigration policies that make housing unaffordable for ordinary working people.

The idea of a home equity tax has also been floated, in which a homeowner would annually pay a tax on the value of their home. That is a home for which they have already paid all the taxes associated with buying a property. Mark Carney’s Liberals claim to reject the idea. But at one time the vacant unit tax would have seemed absurd as well. As Kevin Klein says, “For now, the risk of a home equity tax remains theoretical, but fiscal pressures could change that in the future.” After all, the federal debt has doubled since 2015 (apparently budgets don’t balance themselves) and is now over $1.2 trillion.

15-minute cities are the answer?

Of course, the proposed solution for cities that can’t cope with the growth being imposed on them is never to stop the growth. It’s to find that mythical silver bullet that will accommodate forever growth. One such mythical silver bullet is the 15-minute city. A fifteen-minute city is one where everything you need is accessible within 15 minutes of walking, biking, or using public transit.

The idea originated in Paris and has been embraced by several European cities. In North American cities where policies in zoning, such as residential-only areas, and infrastructure geared toward cars have led to greater sprawl, it faces additional challenges. Nevertheless, Ottawa has adopted the concept of a 15-minute city and is both promoting it and implementing it in various ways. Placards on the hoarding that surround the vacant pit at the intersection of Catherine and Kent Streets, where the Greyhound Bus Station used to be, promote the idea of 15-minute cities. Some of the placards are shown below.

Fittingly, there is a traffic camera on the other side of the road of the 15-minute city placards.

An example of the de facto implementation of a 15-minute city is seen in the Lindenlea neighbourhood of Ottawa, where a single-family home was sold, torn down and replaced with a 12-plex. But no parking is provided in the building. This will make it very difficult for residents to own a car unless they have a bank account dedicated to parking tickets.

But why worry? Who can afford to go anywhere anyway? A study recently published by the Fraser Institute reports that the average Canadian family spends 42.3% of its income on taxes – more than on housing, food and clothing combined. The study says that the average Canadian family’s tax bill increased by 2,784% between 1961 and 2024. Governments at all levels, municipal, provincial and federal, have to pay for all that growth somehow.

Growing our way into ever more restrictions?

As the population grows and traffic along with it, more controls and regulations are imposed through traffic lights, cameras, traffic calming measures such as speedbumps and jutting sidewalks, and a sometimes dizzying plethora of signs telling you the hours and days when you can and cannot make a left turn or any turns at all, prohibiting a right turn on red, restricting a lane to buses, and so on. And of course, parking becomes an expensive nightmare, especially if you get a ticket.

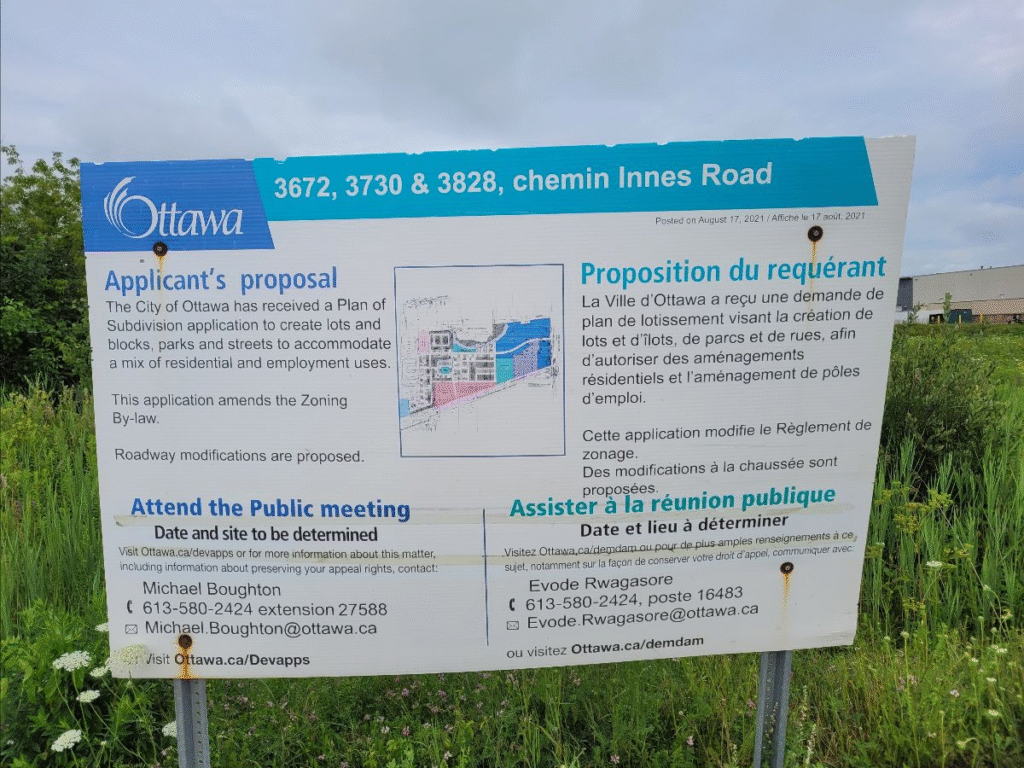

Despite all the hope vested in 15-minute cities, very few residents of Ottawa can go to work or meet their essential daily needs in 15 minutes by walking, biking, or using public transport. And in the face of ongoing growth, sprawl continues apace. No city in the world has grown and not sprawled and Ottawa, with its endlessly sprouting developments, is no exception.

Even moving to the country will not necessarily protect you from experiencing development. Retaining its commitment to high immigration regardless of the financial and social costs, and with big cities already bursting at the seams, the federal government has set its eye on rural communities and small towns with the implementation of its Rural and Northern Immigration pilots. The selected communities will work with Immigration, Refugees and Citizenship Canada (IRCC) to bring in newcomers and contribute to “Canada’s growth and cultural diversity.” You can run from growth, but it will come after you.

Growth is a dog’s breakfast and you’re paying for it

Cars pollute, but most Canadians, old-timers and newcomers alike, still want a family car. Even electric cars pollute when you look at what is involved in manufacturing them, their batteries and their charging stations. Which raises the question of why a federal government allegedly committed to reducing greenhouse gas emissions would continually and rapidly drive the growth of a low-fertility population that would have been stabilized at well below 30 million by bringing in massive numbers of people whose average greenhouse gas emissions increase by a factor of four in their new country. (Unpublished calculations by John Meyer show that the increase in GHG emissions of newcomers to Canada is similar to that in the US).

The reasons given have long been shown to be bogus. Immigration does not significantly affect Canada’s age structure and increases neither per capita wealth nor productivity. Those alleged labour shortages have not been alleviated despite 35 years of perpetually high immigration initiated by Brian Mulroney in 1990.

The massive population growth it has brought (over 12 million since 1990), which became out of control during the last years of Justin Trudeau’s prime ministership, have inflated the cost of housing and led to a housing crisis. It has also led to increased crime and social conflict, putting an increased strain on police resources.

The dollar value of my total municipal tax bill in 2025 was virtually double (x 1.97) that of my first tax payment to the City of Ottawa in 2001. Even taking inflation into account, I’m paying more with no increase in services, let alone quality of life in my rapidly growing city.

Canadians should ask themselves whether they are getting more bang (excluding a rise in shootings) for their buck which is being used to support the growth of the city they live in.

Madeline Weld, Ph.D.

President, Population Institute Canada

Tel: (613) 833-3668

Email: mail@populationinstitutecanada.ca

www.populationinstitutecanada.ca

All content on this website is copyrighted, and cannot be republished or reproduced without permission.

Share this article!

My city keeps raising the property tax percentage too, so with home values going up, we get a double hit. 2% tax one year, 3% tax the next, plus whatever the property value increased by. The middle class is being sucked dry, funding the rich and the welfare recipients alike.